Amortization Scenario/Schedule

Use the Amortization Scenario/Schedule calculator to produce an amortization

table. You can use the calculator pre-populated with details from an open

application, or you can use the calculator with empty fields for you to

input details. If using the latter method, up to 10 scenarios you create

are saved so that you can review at a later time. This allows you to create

“what if" options with your client for paying the mortgage down.

Amortization

Scenario Schedule - with Details

Amortization

Scenario Schedule - without Details

Amortization

Scenario/Schedule - with Details

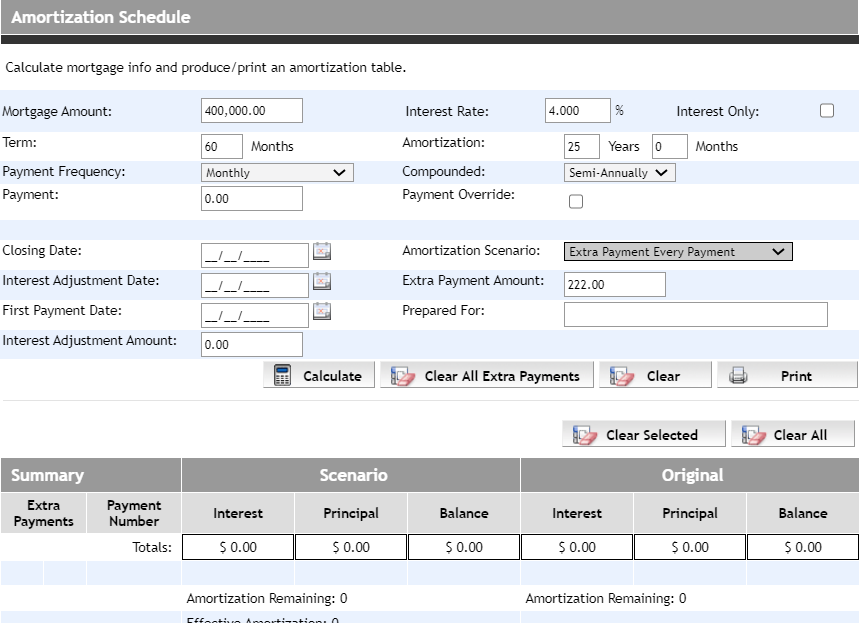

You can use the Amortization Scenario/Schedule calculator with an open

application, which pre-populates the details for you. Complete the following

steps:

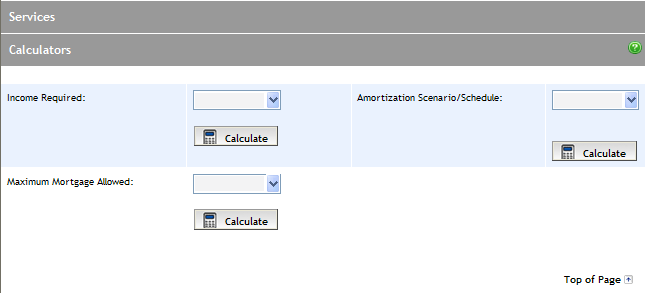

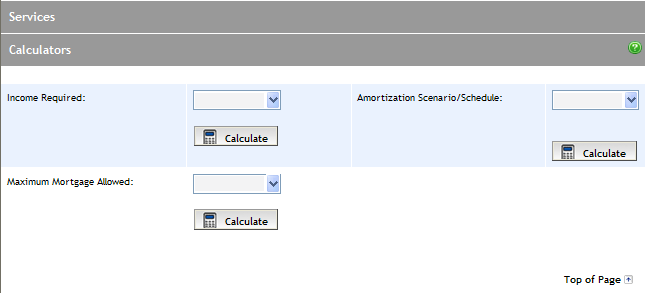

With the application open, click Services

from the Left

Navigation pane. The Services screen appears.

From the Amortization

Scenario/Schedule dropdown in the Calculators section, select

the mortgage of the application to use with the calculator and click

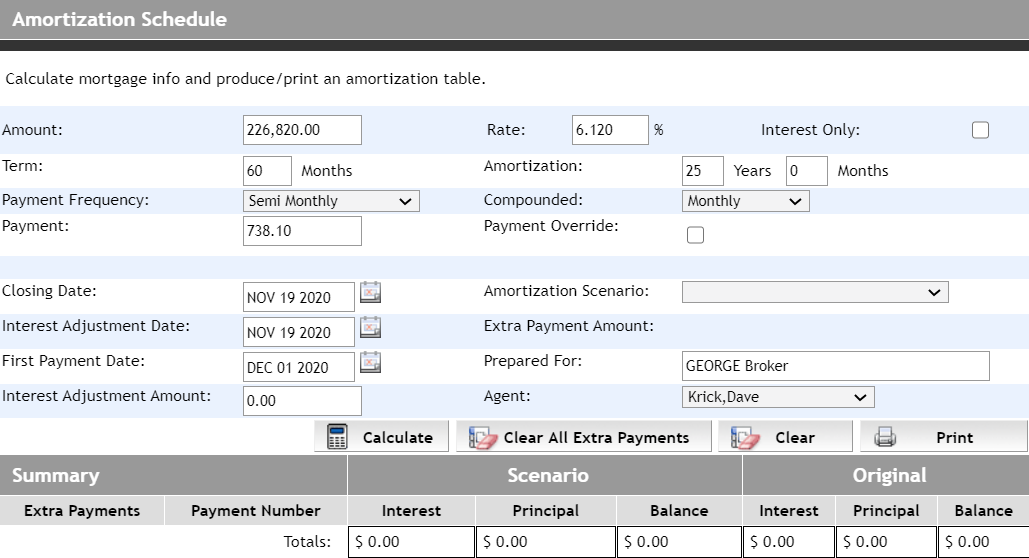

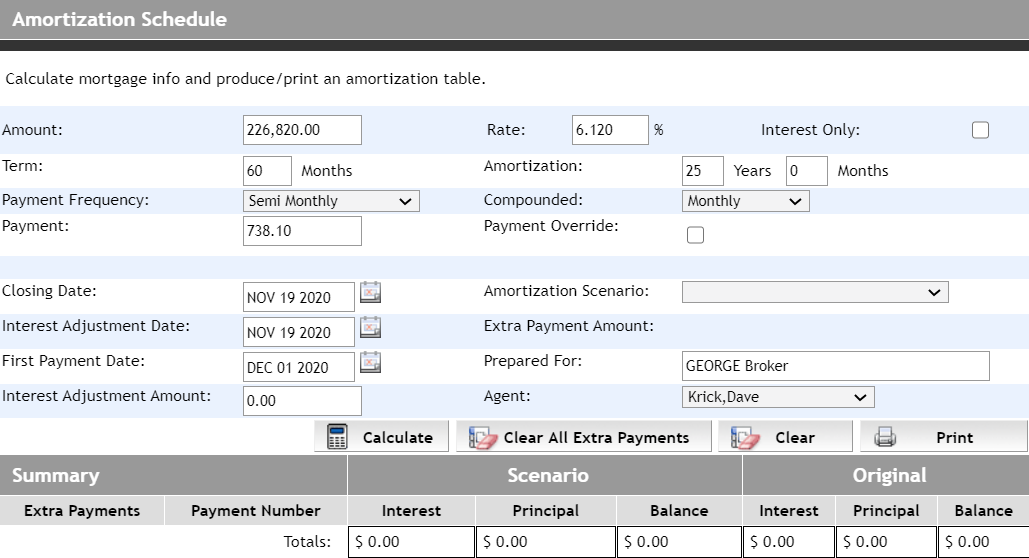

the Calculate button. The

Amortization Schedule screen appears with details automatically populated

from the application.

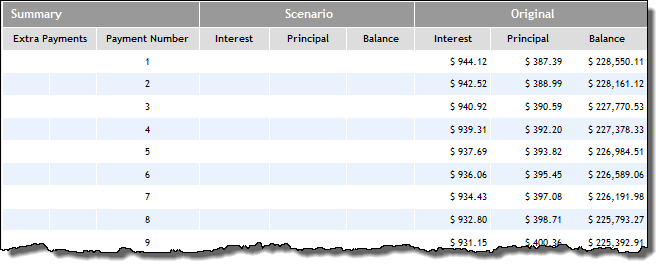

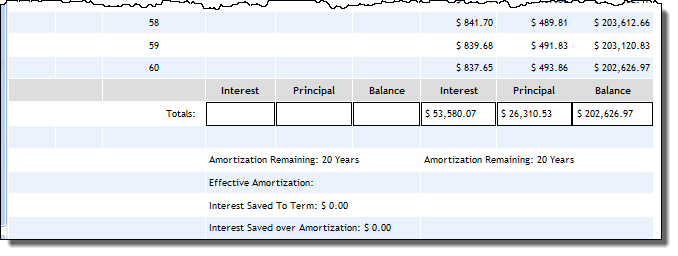

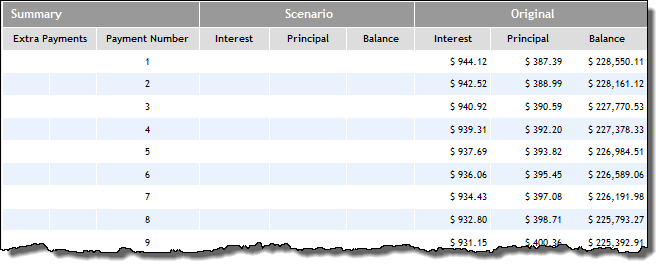

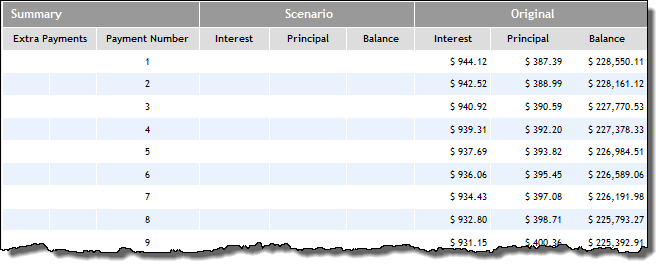

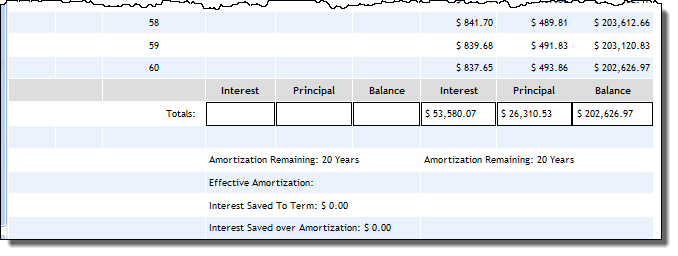

Click the Calculate

button to display the results in the Summary section.

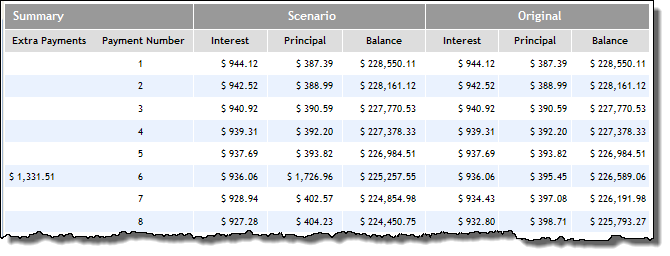

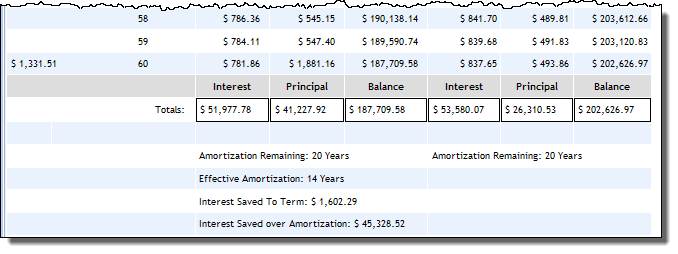

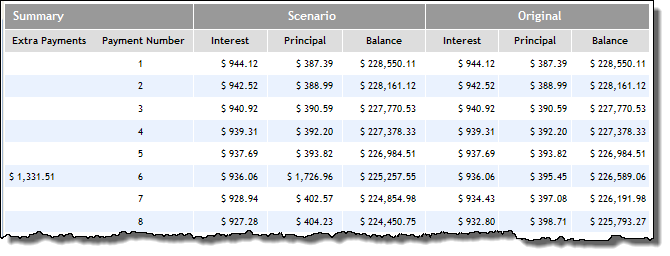

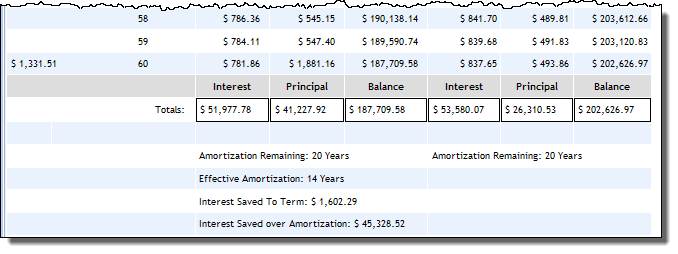

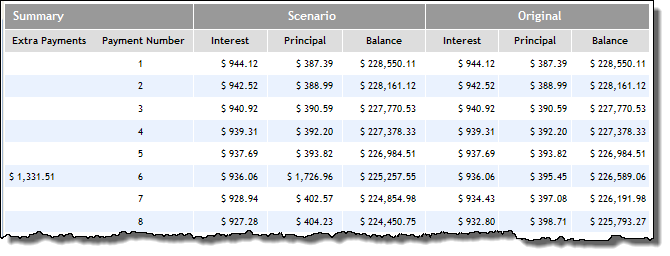

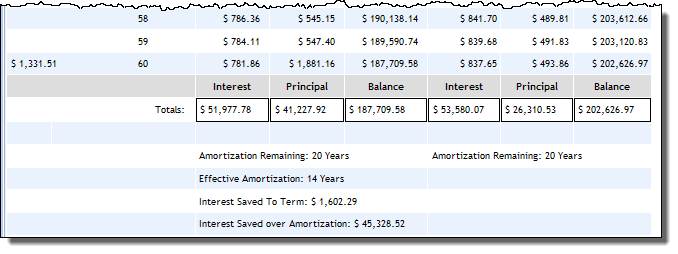

You also have the ability to apply an amortization

scenario for comparison to the original amortization. To do so, select

an amortization option from the Amortization

Scenario dropdown:

Double-Up Twice Yearly

Double-Up Every Other Payment

Extra Payment on Anniversary

Extra Payment Every Payment

Increase Payment Amount Annually

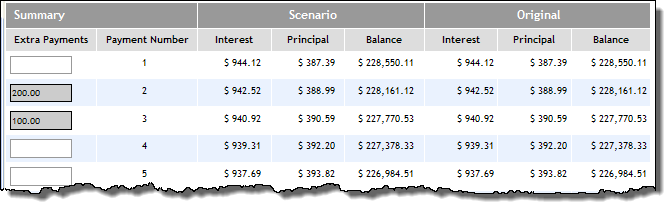

You can enter a value for the extra payment amount

to be applied to all scheduled payments when selecting the Extra

Payment Every Payment scenario. This option prevents you from

having to enter each extra payment amount manually.

For the options of Double-Up

Twice Yearly and Double-Up

Every Other Payment, click the Calculate

button to display the Scenario schedule beside the Original schedule.

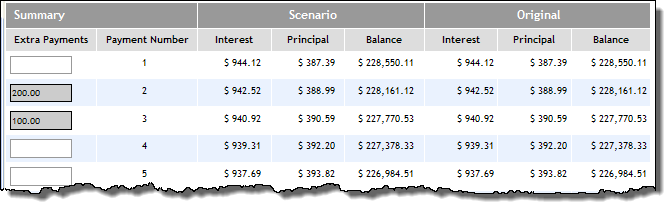

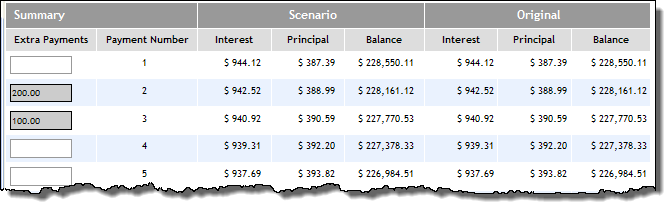

- For the options of Extra Payment

on Anniversary, Extra Payment

Every Payment, and Increase

Payment Amount Annually, click the Calculate

display the Scenario schedule beside the Original schedule. Then enter

the extra payments in the appropriate fields in the schedule, and

click the Calculate button

again to display the results.

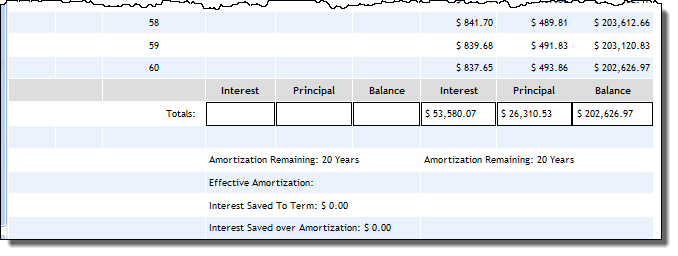

To produce a PDF document of the information for saving

or printing, click the Print

button.

Amortization

Scenario/Schedule - without Details

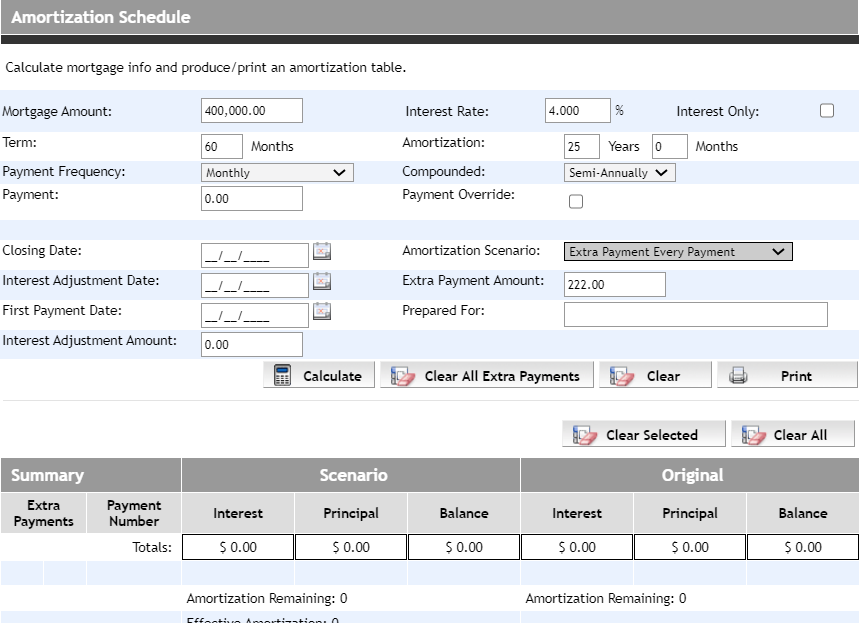

You can open the Amortization Scenario/Schedule calculator with empty

fields for you to input details. With this method, up to 10 scenarios

you create are saved so that you can review at a later time. This allows

you to create “what if" options with your client for paying the mortgage

down.

Click Tools

in the top menu. The Financial Tools screen appears.

Click Amortization

Scenario/Schedule and the calculator opens for you to enter

details.

After entering details, click the Calculate

button to display the results in the Summary section.

You also have the ability to apply an amortization

scenario for comparison to the original amortization. To do so, select

an amortization option from the Amortization

Scenario dropdown:

Double-Up Twice Yearly

Double-Up Every Other Payment

Extra Payment on Anniversary

Extra Payment Every Payment

Increase Payment Amount Annually

You can enter a value for the extra payment amount

to be applied to all scheduled payments when selecting the Extra

Payment Every Payment scenario. This option prevents you from

having to enter each extra payment amount manually.

For the options of Double-Up

Twice Yearly and Double-Up

Every Other Payment, click the Calculate

button to display the Scenario schedule beside the Original schedule.

For the options of Extra

Payment on Anniversary, Extra

Payment Every Payment, and Increase

Payment Amount Annually, click the Calculate

display the Scenario schedule beside the Original schedule. Then enter

the extra payments in the appropriate fields in the schedule, and

click the Calculate button

again to display the results.

To produce a PDF document of the information for saving

or printing, click the Print

button.