Scenario Builder with Open Application

Running Scenario Builder from

an open application allows you to calculate and save different scenarios,

and then select a scenario as the new mortgage. Up to 18 scenarios can

be saved per mortgage in the application. This help topic covers the following

topics:

Conditions to Access

Scenario Builder

Calculating the Scenarios

Saving the Scenarios

Running Comparisons of Scenarios

Setting a Scenario as

the Mortgage

Conditions

to Access Scenario Builder

For Scenario Builder to be accessed from an open application, the deal status must

be In Progress, Approved,

or Submitted.

If any one mortgage in an open application has any of the following

conditions, then Scenario Builder will

not be accessible:

- The mortgage has an accepted lender response

- The mortgage is an MCM (Multi-Component Mortgage)

- The mortgage is an interest-only mortgage

- The mortgage is a Secured LOC

- The mortgage is missing any of the following pieces of information:

- Mortgage Type (1st, 2nd or 3rd)

- Net Rate

- Payment Frequency

- Compounded Period

- Term

- Amortization

- Total Loan Amount.

Calculating

the Scenarios

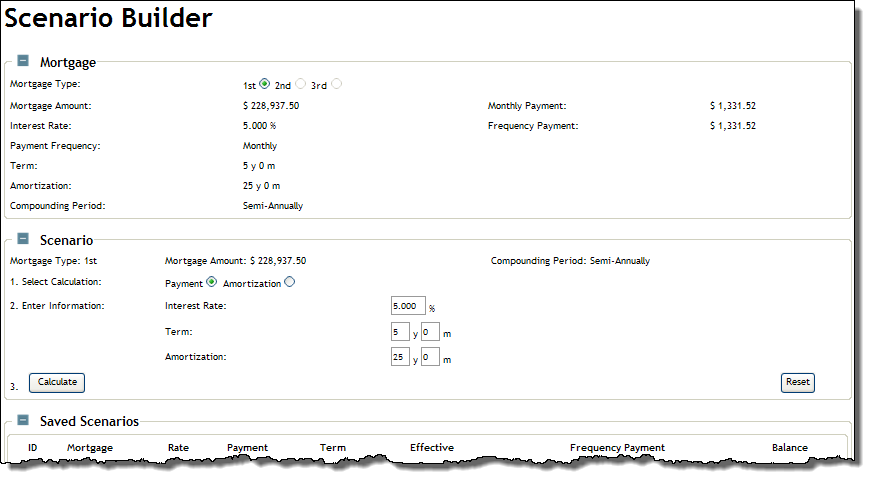

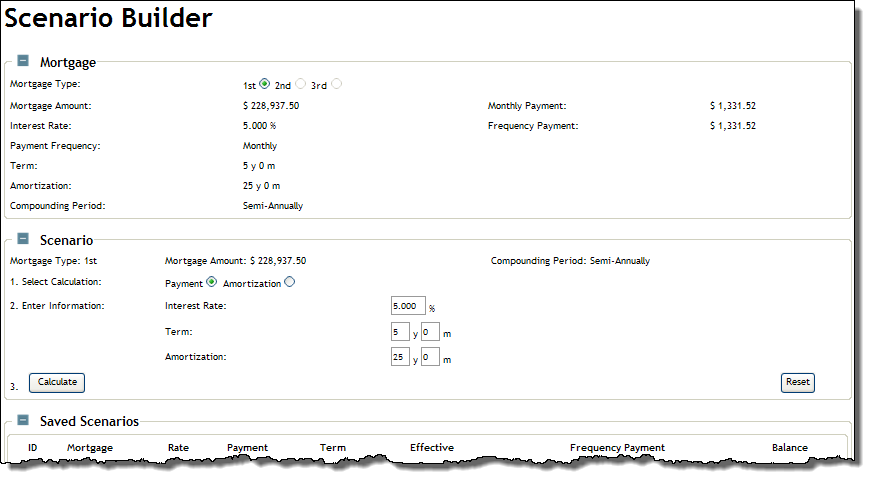

Click Scenario Builder

from the Left

Navigation pane. The Scenario Builder page appears with details

automatically populated from the application.

If there is more than one mortgage on the application, select

the option button (1st, 2nd, or 3rd)

of the mortgage you want to examine. The screen refreshes with the

details of the selected mortgage.

In the Scenario section,

select the calculation type: Payment

or Amortization.

If Payment was selected

in step 3, you can change the following information: Interest

Rate, Term, and Amortization. The monthly payment

will therefore be calculated.

or

If Amortization was selected

in step 3, you can change the following information: Interest

Rate, Term, and Monthly Payment.

Note: The Reset

button disregards any changes you have made to the fields and returns

the original values (i.e., the details in the Mortgage section on

the screen).

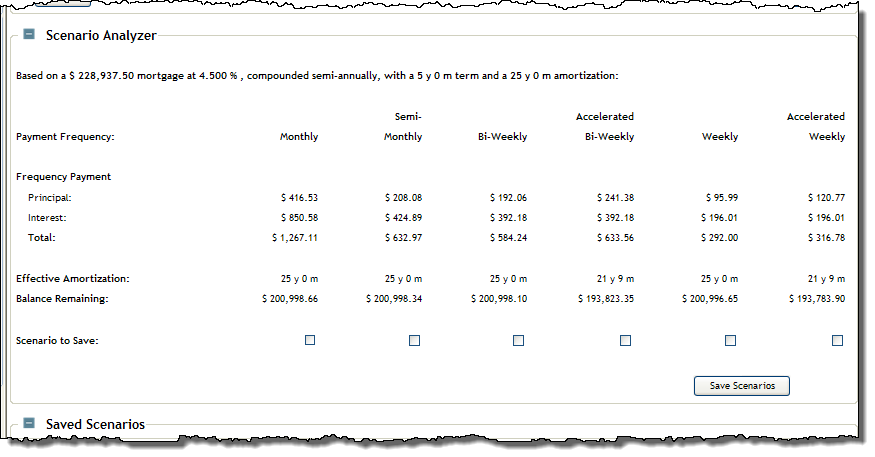

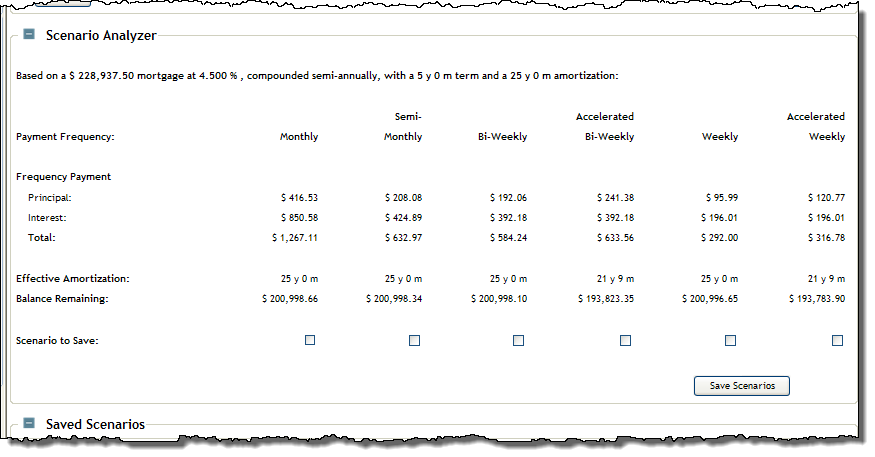

Click the Calculate

button. The screen refreshes with the Scenario

Analyzer section that displays the results of the following

six mortgage scenarios: Monthly,

Semi-Mothly, Bi-Weekly,

Accelerated Bi-Weekly, Weekly, and Accelerated

Weekly. (The screen shot below is based on the Payment

calculation type, as indicated in the explanation below the title).

Note: The compounded period

will be the same of the selected mortgage (in the Mortgage section

on screen).

Saving Scenarios

To save a scenario, select its Scenario

to Save checkbox in the Scenario Analyzer section, and then click

the Save Scenario button. The

screen refreshes and the Saved Scenarios section displays the recently

saved scenario(s). Expert allows up to 18 scenarios to be saved. Therefore

if the limit has been reached, an error message will appear.

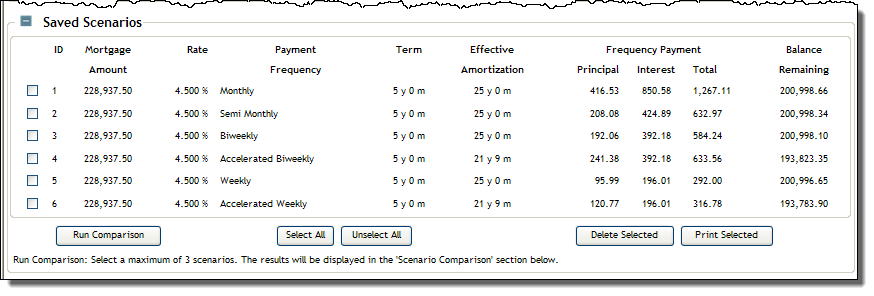

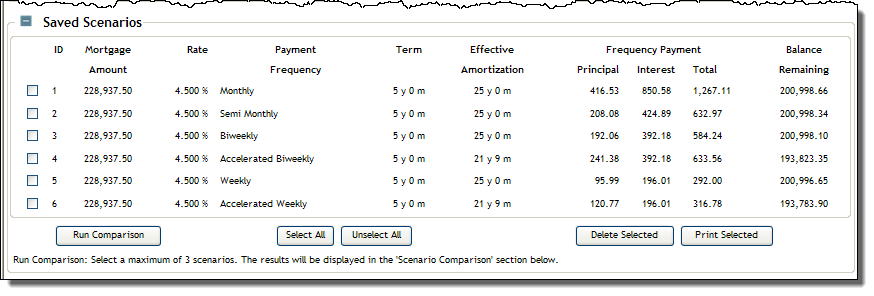

Deleting a Saved Scenario

To delete a saved scenario, select it in the Saved Scenarios section,

and click the Delete Selected

button.

Printing a Saved Scenario

To print a saved scenario, select it in the Saved Scenarios section,

and click the Print Selected button.

Running

Comparisons of Scenarios

You can compare up to three saved scenarios against the selected mortgage

(the selected mortgage is displayed in the Mortgage section on the Scenario

Builder page), complete the following steps:

In the Saved Scenarios

section, select the scenarios you want to compare. You can select

a maximum of three.

Click the Run Comparison

button. The screen refreshes with the Scenario Comparison section

displaying the results.

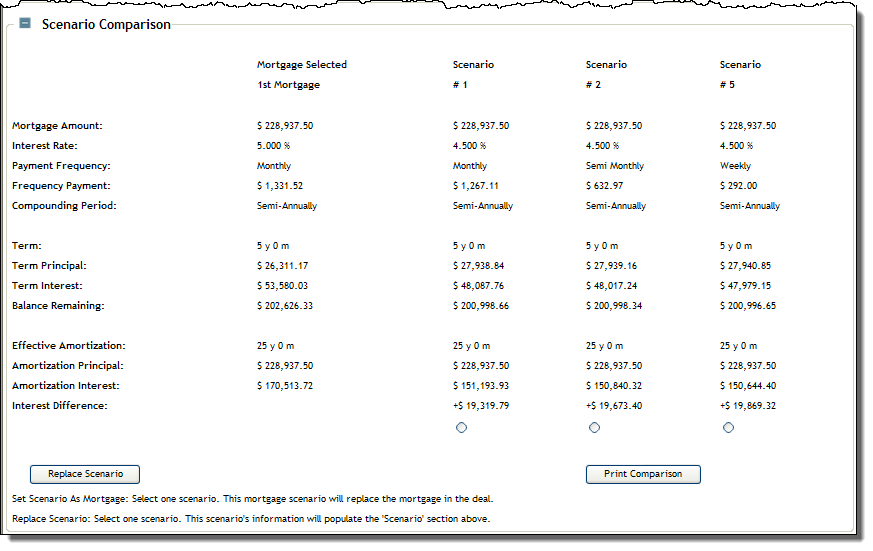

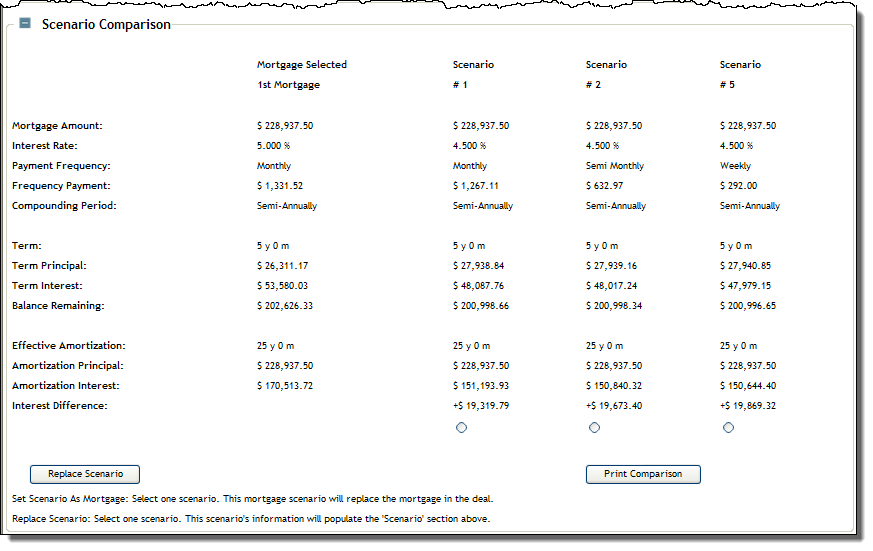

The "Replace Scenario" Feature

A scenario displayed in the Scenario Comparison section can be selected

to populate the Scenario section on the Scenario Builder page. Select

the option button of the desired scenario and click the Replace

Scenario button. The screen refreshes and the Scenario section

displays the details of the scenario.

Printing Comparisons

To print the comparisons displayed in the Scenario Comparison section,

click the Print Comparison button.

A PDF document is generated and opened in a separate window, from which

you can print.

Setting

a Scenario as the Mortgage

A scenario that has been run as a comparison can then be selected to

be set as the new mortgage. Doing so will overwrite the mortgage information

on the Application

Edit screen.

From the Scenario Comparison section, select the scenario that

is to replace the mortgage.

Click the Set Scenario As Mortgage

button. The screen refreshes and the existing mortgage is replaced.