Entering Existing Properties and Mortgages of Applicant

The Properties Owned By Applicant section on the Applicant

Details screen is to add details of any existing properties and mortgages

the applicant or applicant pair have. Doing so will also update the Assets

and Liabilities

section respectively.

Refinance Note: If

the Application Purpose is a Refinance type, a selected is displayed in this section. This indicates that

this section mirrors the Subject

Property Information section of the Application Edit screen. Changing

a field in one section also changes its equivalent field in the other

section.

Adding

an Existing Property

Adding

a Mortgage on an Existing Property

Adding

an Existing Property

To add an existing property owned by the applicant(s), complete the

following steps:

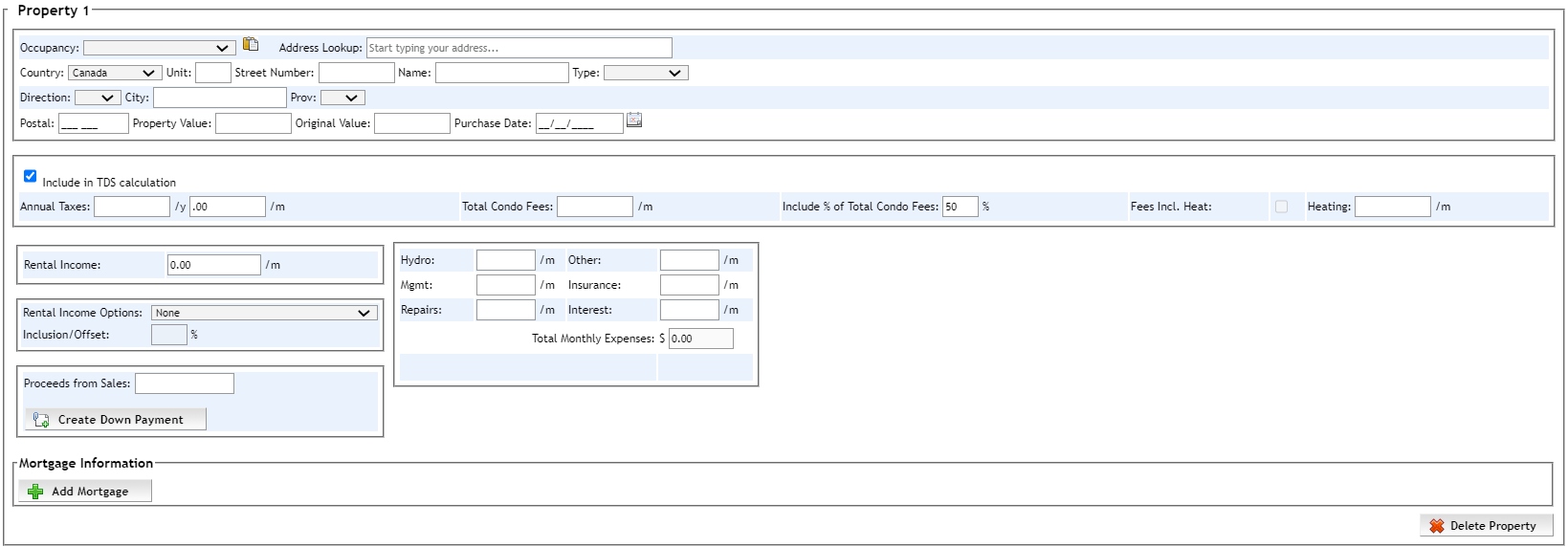

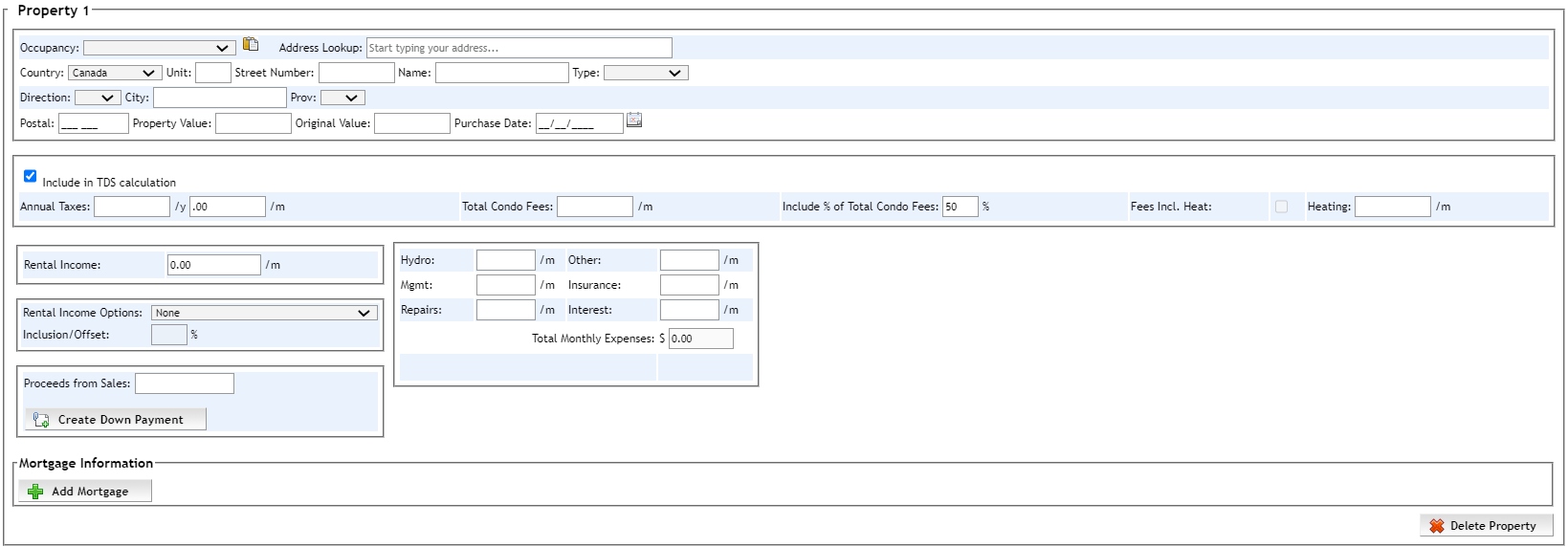

Click the Add Property button. The screen

refreshes to display the fields of the Properties Owned by Applicant

section.

From the Occupancy dropdown, select how the

existing property is being used:

Owner-Occupied (select this option if the applicants currently

live in the property).

Owner-Occupied and Rental

Rental

Second Home

To copy the

applicant's current address (from Address

section) into the address fields of this section, click the copy/paste

icon ( ). Otherwise enter

the address details manually.

). Otherwise enter

the address details manually.

Tip: Use the Address

Lookup field to search, find and pre-fill the address of the

property.

Enter the value

of the property in the Property Value

field. The Assets

section is updated with this property and value. Enter the Original Value and Purchase

Date.

Enter the Annual Taxes, Total

Condo Fees (if any) and Heating.

If the heating is included in the condo fees, check the Fees

Incl. Heat checkbox.

To include

the property taxes, condo fees, and heat in the TDS

calculation, select (check) the Include

in TDS calculation checkbox.

Refinance Note: If the Application Purpose is a type, the Include in TDS calculation checkbox

must be checked (selected).

If Rental

or Owner-Occupied Rental is

selected in the Occupancy

dropdown, then complete the following fields:

Rental Income

Rental Expense fields (Hydro,

Mgmt, Repairs,

Other, Insurance,

Interest)

Rental Income Options - if a portion of the rent is used as

income, you have the following options:

None

- no rental income is added to the applicant's gross income. The TDS calculation

is not affected.

Add Percentage to Gross Income - adds a percentage of the rental

income to the applicant's gross income. Enter the percentage in the Inclusion/Offset field. This income

is included in the TDS calculation.

Reduce Rental expense, add balance to gross income - deducts total

expenses (including mortgage payment, taxes, condo fees and heating costs)

from the rental income, and from the remaining rental income, a percentage

is added to the applicant's gross income. Enter the percentage in the

Inclusion/Offset field. This income

is included in the TDS calculation.

If

the property is to be sold, then the proceeds from the sale can be

included as a down payment for the new mortgage. In the Proceeds

from Sales field, enter the amount that is to be applied to

the down payment. Then click the Create

Down Payment button to enter this amount in the Down Payment section of

the Application Edit screen.

Refinance Note: If the Application Purpose is a type, a portion

of the equity on the existing property can be used to create a down

payment for a new mortgage. In the Property

Equity field, enter the amount that is to be used for the down

payment. Then click the Create Down

Payment button to enter this amount in the Down

Payment section of the Application Edit screen.

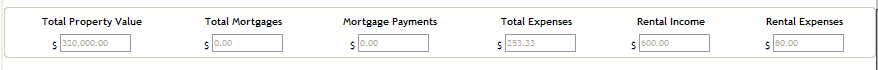

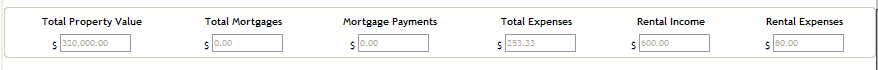

Click

the Save button. At the bottom

of the screen, the Total Property

Value, Total Expenses,

Rental Income

(if any), and Rental

Expenses (if any) fields are

filled with the associated values.

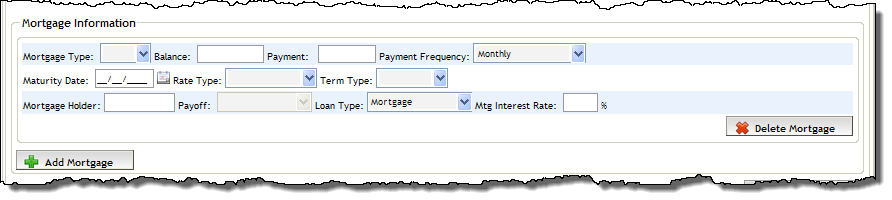

Adding

a Mortgage on an Existing Property

If there is any mortgage remaining on the existing property, it must

be added. Complete the following steps.

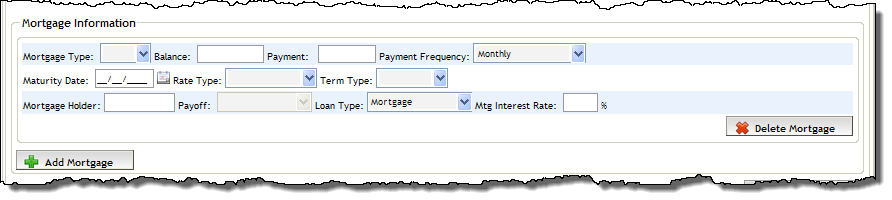

Click the Add Mortgage button. The screen

refreshes to display the fields of the Mortgage Information subsection.

Refinance Note: If the Application Purpose is a Refinance type,

additional fields are available in the subsection to enter the original

mortgage amount and number. to view.

Complete the

necessary fields. When Payment

is entered, this amount is copied as a liability in the Liabilities section. This

amount is also included in the TDS

calculation.

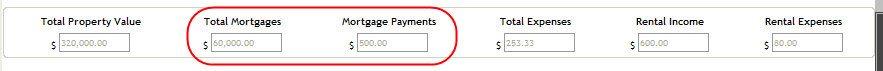

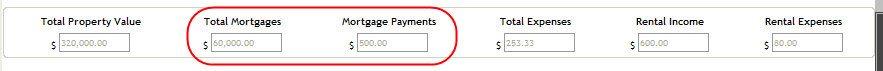

Click the Save button. At the bottom of the

screen, the Total Mortgages

and Mortgage Payments

fields are filled with the associated values.

![]() ). Otherwise enter

the address details manually.

). Otherwise enter

the address details manually.