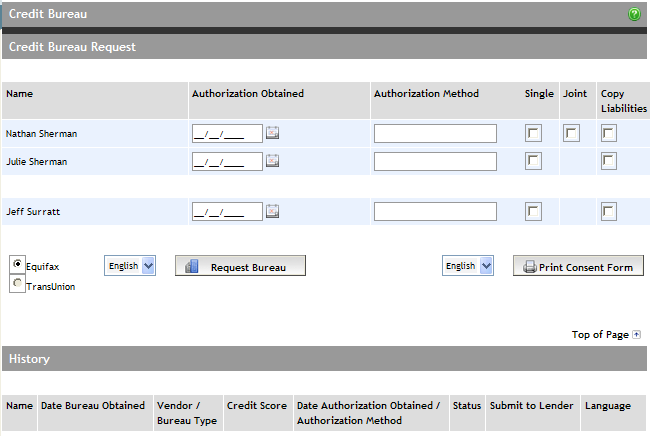

From the Left

Navigation Pane, click Credit

Bureau. The Credit Bureau screen appears.

To print a consent form, click the Print

Consent Form button. The consent form opens as a PDF document

in a separate window, from where it can be printed.

Once authorization is obtained for an applicant, enter

the date in the Authorization Obtained

field using the dynamic calendar.

In the Authorization

Method field, enter the authorization method. For example,

"Written Consent".

If an applicant pair is on the application, you have

the option of requesting a joint credit bureau report. Do so by selecting

the Joint checkbox. Otherwise,

select the Single checkbox

for the applicant.

Liabilities received from the credit bureau report

can be automatically populated into the Liabilities

section of the Applicant Details screen. To have this occur for

an applicant, select that applicant's Copy

Liabilities checkbox. (Note that the checkbox may already be

selected if the Copy Bureau on Request

option was selected in the Liabilities

section of the Applicant Information screen).

Select the credit bureau to pull: Equifax

or TransUnion. If one of the

bureaus is not available, it means it is not enabled for your firm.

To have the bureau enabled, see your firm administrator.

Click the Request

Bureau button.

The request is submitted. When the report arrives, it is displayed in the History section of the screen. See Viewing and Printing a Credit Bureau Report