How do I find and interpret an Equifax Error Code?

When copying an application, does the credit bureau report get copied over?

On the Forms screen, I only see the Consent Form. Where are the other documents?

Why doesn't the MPP Request form appear in the Forms screen?

Why can't I edit the mortgage details?

How do I unlock a deal after the lender response is accepted?

When to include tax, heat, and condo fees (if any) from existing properties in the TDS calculation?

How do I find and interpret an Equifax Error Code?

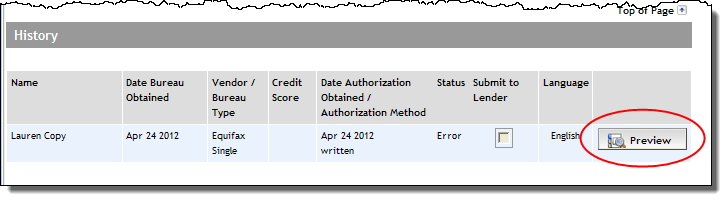

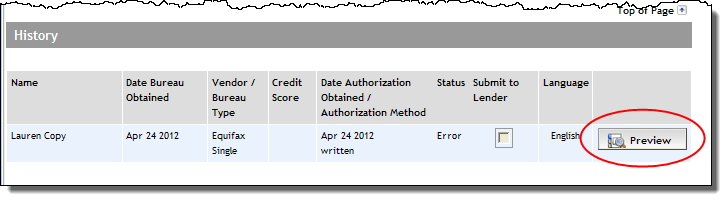

When a credit bureau report containing

an error code is received, its status reads Error

in the History section of the Credit Bureau screen. By clicking the Preview button (circled below),

the report opens as a PDF document in a separate window.

The error code is the last three

digits indicated in the example report below. To view Equifax Error Codes,

click

here.

Help

file topic: Viewing

a Credit Bureau Report

Any credit bureau reports that have been pulled in the original application are copied over to the new application only if the original application was submitted online to a lender, and if the report is less than six months old.

Help file topic: Copying an Existing Application

On the Forms screen, I only see the Consent Form. Where are the other documents?

If there is no mortgage yet entered on the deal, then the documents associated with the mortgage (e.g., Mortgage Summary, Disclosure forms, etc.) do not display on the Forms screen.

Help file topic: Mortgage Forms and Documents

If the deal is a pre-approval, the MPP (Mortgage Protection Plan) Request does not appear on the Forms screen.

Help file topic: Mortgage Forms and Documents

If Expert is preventing the mortgage details from being edited, it indicates that the Lender Response has been accepted for that mortgage. Therefore the deal is considered "locked." You can unlock the deal by clicking the Un-Accept button on the Lender Response screen.

Help file topic: Un-Accepting a Response

If you access an existing deal, and cannot select a Mortgage Type (i.e., first, second, or third) for the Mortgage Request Details, it indicates that the mortgage has been co-brokered. A co-brokered mortgage also prevents the Application Purpose from being changed. To edit these details, you will be required to break the link to the co-brokered mortgage.

Help

file topics: Things

to Know About a Co-Brokered Mortgage and Breaking

Link to a Co-Brokered Mortgage.

You can unlock the deal in order to edit it by clicking the Un-Accept button on the Lender Response screen.

Help file topic: Un-Accepting a Response

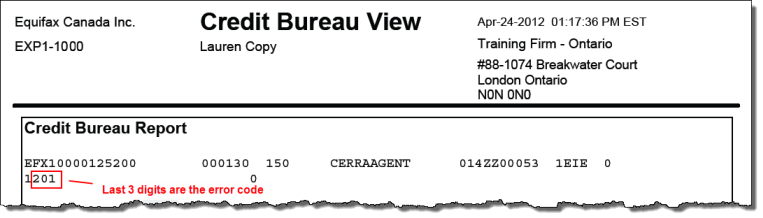

If the application purpose is

Refinance or ETO, then annual taxes, heat, and any condo fees must be

included in the TDS. Ensure the Include in TDS

calculation checkbox (below) is selected for the property in the

Propertied Owned by Applicant section.

Help file topic: Entering Existing Properties of Applicant